One Accounting Tax, Inc.

29 Commercial St, Braintree, MA 02184, United States

617-829-0928

Navigate Your Finances

- The Indispensable Role of a Qualified Accountant in Our Complex Economy

- Full-Suite Financial Support: From Bookkeeping to Payroll Services

- Navigating Tax Season with an Dedicated Tax Accountant

- Gaining Financial Guidance from a Tax Consultant

- Enhancing Your Financial Operations with copyright Services

Achieve Financial Peace of Mind with the Support of a Qualified Accountant

Managing personal or business finances is often challenging in our intricate economic environment. Ranging from daily transactions to strategic investments, ensuring compliance is paramount. This is where the expertise of a qualified Accountant are indispensable. An Accountant does more than just crunching numbers; they provide strategic advice into your financial health. They assist you interpret your financial position, meet legal requirements, and plan for the future. If you're an individual taxpayer needing help with tax planning or a company needing comprehensive financial oversight, a skilled Accountant is an essential ally. Additionally, hiring a knowledgeable Tax Consultant offers specialized advice tailored to your unique tax situation. Ultimately, partnering with financial professionals helps you to attain your financial goals with clarity.

Comprehensive Suite of Financial Services: Beyond Basic Accounting

Professional financial firms and individuals deliver a diverse portfolio of services tailored to meet the multifaceted needs of individuals and individuals. Core Accounting is the foundation, but true financial support encompasses more. These offerings strive to improve efficiency, ensure compliance, and provide clear reporting for strategic planning. From transaction management to strategic financial advice, experts can handle multiple financial tasks. Utilizing these specialized offerings enables business owners to concentrate on their primary goals confident their finances are managed professionally. Key services provided in addition to standard Accounting include:

- Accurate Bookkeeping to manage income and expenses.

- Timely Payroll Services for employee compensation.

- Stress-free Tax preparation service for businesses.

- Proficient copyright Services for ongoing support.

- Strategic advice from an experienced Tax Consultant.

This comprehensive approach guarantees your complete financial needs are addressed effectively.

"Diligent Bookkeeping isn't merely about recording transactions; it's the cornerstone of effective Accounting. Pairing it with strategic advice from a Tax Consultant provides optimization opportunities and guarantee long-term compliance."

Maximize Your Deductions with a Dedicated Tax Accountant

The realm of taxation is always shifting, with complex rules that are often confusing for business owners to navigate alone. This is where the focused expertise of a Tax Accountant is highly beneficial. Different from a general Accountant who handles a broader range of financial tasks, a Tax Accountant specializes primarily on tax law, planning, and compliance. They keep informed on the most recent tax codes and strategies to legally minimize your tax burden and maximize potential refunds. Hiring a professional Tax preparation service, usually managed by a Tax Accountant, guarantees accuracy and minimizes the risk Additional reading of costly errors or audits. Furthermore, a good Tax Accountant delivers proactive advice continuously, not just during tax season, guiding you make tax-efficient decisions. For personal returns or partnership taxes, collaborating with a dedicated Tax Accountant provides peace of mind and optimal financial outcomes.

"Running my small business left very limited time to deal with the intricacies of Accounting and taxes. We were struggling with Bookkeeping and dreading tax season. Partnering with these experts was a game-changer. Their integrated approach, including meticulous Bookkeeping, efficient Payroll Services, and expert copyright Services, organized everything. The Tax Consultant offered invaluable advice proactively, not just the basic Tax preparation service. They identified deductions we never knew existed and helped me implement better financial strategies. Today, I have accurate insights, less stress, and valuable time back to grow the business. Their level of professionalism is genuinely top-notch!"

Common Financial Queries

- Q: What's the main difference between a general Accountant and a Tax Accountant?

A: Although both are financial professionals, a general Accountant manages a broader range of financial activities, including Bookkeeping, financial statement preparation, budgeting, and general business advice. A Tax Accountant concentrates on tax law, tax planning, tax return preparation (Tax preparation service), and representing clients before tax authorities. Some individuals may perform both roles, but specialization means deeper expertise in the respective area. - Q: When should a small business consider outsourcing its Payroll Services or Bookkeeping?

A: Many owners consider outsourcing Payroll Services or Bookkeeping when these tasks require significant time, when accuracy becomes a concern, or as the business grows and compliance become more complex. Outsourcing helps business owners to focus on core operations, avoid errors, and benefit from greater expertise than they could afford internally. - Q: What are the benefits of using professional copyright Services versus doing it in-house?

A: Professional copyright Services provide several benefits. Experts can ensure copyright is optimized for your specific business needs, preventing errors down the line. They offer training to your team, ensure data accuracy through regular reviews or Bookkeeping, provide better reporting, and troubleshoot issues efficiently. This means more reliable financial data for decision-making and often saves significant time and frustration compared to in-house handling without expertise.

Choosing Your Financial Partner

| Criteria | Professional Accountant / Tax Consultant | Less Experienced Options |

|---|---|---|

| Accuracy & Compliance | Ensured Compliance | Increased Chance of Errors & Penalties |

| Strategic Tax Planning | Expert Tax Planning & Optimization | Limited Tax Savings Opportunities |

| Reporting Quality | Valuable Insights & Custom Reports | Basic Reporting & Understanding |

| Time Savings | Substantial Time Savings for Business Owners | Time-Consuming Personal/Staff Effort |

| Audit Support | Professional Representation if Needed | Limited Support in Audits/Issues |

| Service Scope | Offers Payroll Services, copyright Services, etc. | Typically Excludes Specialized Services |

Testimonials

"Switching to this firm's Tax preparation service was so much better than my previous provider. The Tax Accountant assigned to us was highly professional and made the effort to understand my business structure. They didn't just filing the return; the Tax Consultant aspect offered valuable advice for future planning. The level of detail in their Accounting practices put me at ease. I am better prepared financially. Strongly suggest their comprehensive services!"

– Sarah L.

"Outsourcing our Bookkeeping and Payroll Services to this team has been one of the best decisions for our business. The Accountant got us started with efficient systems, integrated copyright Services. The reliability of their Bookkeeping is flawless, and the Payroll Services run like clockwork every time. It saved an incredible amount of internal time and eliminated stress significantly. Their overall Accounting support is top-tier. We're now confident in our numbers about our financial health. A great partner!"

– David Chen, CEO

Judd Nelson Then & Now!

Judd Nelson Then & Now! Michael J. Fox Then & Now!

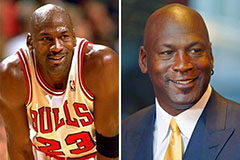

Michael J. Fox Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now!